Every dollar we earn, spend, save, or invest leaves a mark on our lives and the world around us. As consumers, workers, and investors, we hold the power to shape economies, societies, and ecosystems.

By understanding and managing our cumulative record of financial activities, we can steer our resources toward prosperity, resilience, and sustainability.

What is Your Personal Financial Footprint?

Your personal financial footprint is the trail of decisions that define your economic identity. It encompasses every source of income, spending choice, saving habit, investment move, debt obligation, and even forgotten assets.

- Income and employment pattern: wages, side hustles, dividends, pensions, and benefits.

- Spending behavior: essentials like housing and transport, plus leisure subscriptions and donations.

- Saving and investment: bank accounts, retirement plans, real estate, mutual funds, and more.

- Debt and liabilities: mortgages, student loans, credit cards, and other obligations.

- Financial infrastructure: dormant accounts, loyalty points, historic pension rights, and unclaimed refunds.

- Legal and estate elements: wills, trusts, beneficiary designations, and powers of attorney.

Many people overlook where your financial footprints hide: unclaimed stock options, foreign pension entitlements, or small refund credits. Conducting a thorough inventory of these elements can unlock hidden value and prevent assets from falling through the cracks.

From Your Wallet to the World: Your Economic Footprint

Our individual financial actions ripple through the economy via direct, indirect and induced impacts. When you earn a salary, you contribute to GDP. When you spend on groceries, you support farmers, transporters, retailers, and their workers. As these employees spend their wages, new demands arise, fueling a web of economic activity.

Conceptually, you can ask yourself:

- What is my personal GVA (Gross Value Added) through work or entrepreneurship?

- How many jobs do my spending and investments support?

- How much do I invest in my own “R&D” through education, training, and healthcare?

For perspective, Canada’s investment funds industry generated C$37.1 billion in GDP in 2018, supported 81,000 full-time jobs, and contributed C$7.3 billion in total tax revenues. Though our individual footprints are smaller, they follow the same principles.

Triple Bottom Line: Beyond Dollars and Cents

True sustainability measures an individual’s impact across three dimensions: economic, social and environmental sustainability.

Economic footprint considers income, employment, productivity, and innovation. Social footprint examines how our spending and investments affect labor conditions, community well-being, and inequality. Environmental footprint tracks resource use, emissions, and ecosystem impacts tied to what and how we finance or consume.

By viewing our financial decisions through this lens, we can align our portfolios and purchasing habits with our values and long-term planetary health.

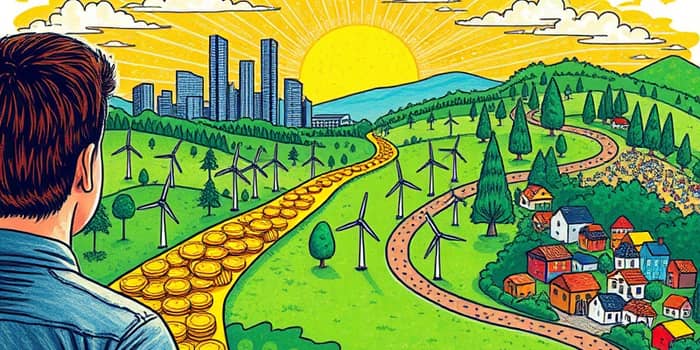

Strategies to Shape a Positive Financial Footprint

Every step you take today can reshape your future trajectory and the well-being of others. Consider these practical actions:

- Mindful spending aligned with values: Redirect expenses toward businesses with fair labor practices and sustainable supply chains.

- Impact investing in green technologies: Channel capital into renewable energy, clean water projects, and circular economy ventures.

- Diversify income for greater resilience: Explore side hustles, passive income sources, and professional development to strengthen stability.

- Reduce and manage debt effectively: Prioritize high-interest obligations and avoid overleveraging to maintain a strong credit profile.

- Plan your legacy intentionally: Use wills, trusts, and beneficiary designations to ensure your assets benefit your heirs and causes you care about.

By adopting these practices, you not only fortify your personal finances but also contribute to healthier economies, more equitable societies, and a cleaner planet.

Remember that small changes compound over time. Redirecting a fraction of your monthly budget can support innovative research, protect vulnerable communities, and reduce environmental harm. Your financial footprint is more than a statement of wealth—it is a testament to the world you want to build.

Embrace the opportunity to measure, manage, and magnify the positive impacts of every dollar you move. When you align money with meaning, you leave a legacy that resonates beyond your lifetime.

References

- https://www.wifor.com/en/economic-footprint/

- https://diversification.com/term/economic-footprint

- https://www.sima-amvi.ca/wp-content/themes/ific-new/util/downloads_new.php?id=22903&lang=en_CA

- https://fincent.com/glossary/financial-footprint

- https://energy.sustainability-directory.com/term/financial-sector-footprint/

- https://yourlegal.org/glossary/financial-footprint/

- https://www.wisdomlib.org/concept/financial-footprint