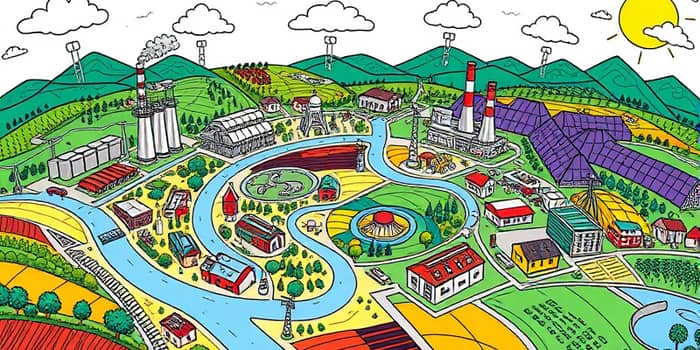

In a world facing resource scarcity and environmental degradation funding solutions that go beyond business as usual is critical. The circular economy offers a transformative vision that reconnects production with natural cycles while unlocking new investment opportunities. By shifting from a linear take-make-dispose mindset to a model of production and consumption that emphasizes reuse, repair, and regeneration investors and businesses can cultivate resilient growth and enduring value.

At its heart the circular economy rejects waste as a concept. It aspires to waste is eliminated and resources circulated until molecules and materials return to nature or return to production. This dynamic framework holds promise for cutting emissions, creating millions of skilled jobs, and generating billions of dollars in savings. The time to align capital with the principles of circularity is now.

Defining the Circular Economy

The circular economy is built on three interlocking principles that reshape how we design produce and interact with materials and products. This systemic approach honors both ecological boundaries and economic opportunity by rethinking every stage of a product lifecycle from conception to end of life.

- Design out waste and pollution: Embed circularity from the earliest design decisions to stop waste before it starts.

- Keep products and materials in use: Embrace strategies like repair refurbishment and reuse to prolong value and functionality.

- Regenerate natural systems and ecosystems: Return nutrients to soil support biodiversity through practices such as composting and regenerative agriculture.

Moreover the circular economy distinguishes between biological and technical cycles. Biological materials safely reenter the biosphere. Technical products are maintained repaired and recycled in quality loops. Enablers like Product-as-a-Service models and sharing platforms further enhance utilization rates and minimize idle assets.

Driving Global Macro Trends

Several converging macro trends have elevated circularity from concept to policy priority. Rapid population growth puts unprecedented pressure on finite raw materials. The global population is projected to near 10 billion by 2050 intensifying demand for water energy metals and agricultural inputs. Meanwhile geopolitical tensions and volatile commodity markets amplify supply chain risks.

Climate imperatives also underscore the urgency of material efficiency. Nearly 45% of global greenhouse gas emissions stem from producing food materials and manufactured goods. Circular strategies promise a potential reduction in global greenhouse gas emissions by up to 39% across key sectors. By designing out waste and optimizing material loops businesses can make deep emission cuts beyond the energy transition alone.

In parallel mismanagement of waste fuels pollution crises on land and in our oceans. Plastic leakage threatens marine ecosystems while textile waste represents hundreds of billions of dollars in squandered value each year. Consumers and governments alike now demand ethical eco friendly solutions placing brands at the forefront of circular innovation.

Quantifying the Benefits

Beyond environmental gains the circular economy delivers measurable economic and social value. Consider the following snapshot of sectoral impact:

Circular practices can reduce dependency on virgin materials by up to 90% in optimized systems. Companies that implement high quality recycling and remanufacturing achieve significant cost savings and shield themselves from volatile commodity prices. Globally adopting circular business models could unlock $640 billion in material cost savings by 2050.

On the social front millions of skilled jobs emerge in repair recycling composting and sustainable design. In the European Union alone circular economy initiatives are expected to create 700,000 new roles by 2030 driving local economic development and inclusive prosperity.

Investing by Sector and Asset Class

Investors can channel capital into diverse vehicles that fuel circular growth. Private equity funds focused on resource efficiency technologies are gaining traction. Green bonds tied to circular infrastructure projects attract institutional demand. Real estate investors can refurbish existing structures to circular standards yielding both environmental benefits and higher asset values.

Sector wise the built environment offers low risk high reward opportunities through adaptive reuse of buildings modular construction and material passports. In textiles platforms for clothing rental and take-back schemes reduce waste at scale. The agricultural sector benefits from investments in regenerative practices and bio based materials that replenish ecosystems.

Policy and Regulation as a Catalyst

Governments play a pivotal role in accelerating circular transitions. Regulatory frameworks can mandate waste reduction set recycling targets and incentivize repair markets. The European Union has embedded circularity into its industrial strategy through restrictions on single use plastics and requirements for extended producer responsibility.

- Extended producer responsibility schemes shifting end of life costs onto manufacturers

- Material efficiency standards for construction and consumer goods

- Tax incentives for refurbishment leasing and resource recovery

By aligning fiscal policy with circular objectives public authorities can mobilize private capital and de risk early stage circular ventures.

Practical Steps for Investors and Businesses

- Audit material flows across the value chain to identify reuse opportunities.

- Partner with reverse logistics providers to establish take-back systems.

- Allocate R&D budgets to modular design and durable product components.

- Incorporate circularity metrics into investment due diligence processes.

- Engage policy makers to support enabling regulations and incentives.

These actions create a roadmap for organizations seeking to align portfolios with enduring resource efficiency and environmental stewardship goals. Early movers often capture market share and gain competitive advantage in emerging circular markets.

Conclusion: A Call to Action

The circular economy is more than a buzzword—it is a comprehensive framework for achieving long term sustainable economic growth while safeguarding the planet. By adopting circular principles businesses reduce costs increase resilience and open pathways to new revenue streams. Investors who recognize the magnitude of this transition stand to generate both strong returns and social impact.

Our global challenges demand solutions that treat waste as a design flaw and natural systems as the ultimate beneficiaries. Embracing circularity is an investment in a future where people prosperity and the planet thrive together. Join the movement and direct capital toward sustainable growth that endures across generations.

References

- https://www.wastemanaged.co.uk/our-news/recycling/circular-economy-guide/

- https://www.rts.com/blog/benefits-of-circular-economy/

- https://www.immerse.education/beyond-syllabus/economics/what-is-the-circular-economy-definition-benefits/

- https://gaiacompany.io/benefits-of-a-circular-economy/

- https://www.europarl.europa.eu/topics/en/article/20151201STO05603/circular-economy-definition-importance-and-benefits

- https://www.ube.ac.uk/whats-happening/articles/circular-economy/

- https://www.unepfi.org/pollution-and-circular-economy/circular-economy/

- https://www.weforum.org/stories/2025/09/circular-economy-built-environment-future/

- https://www.ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview